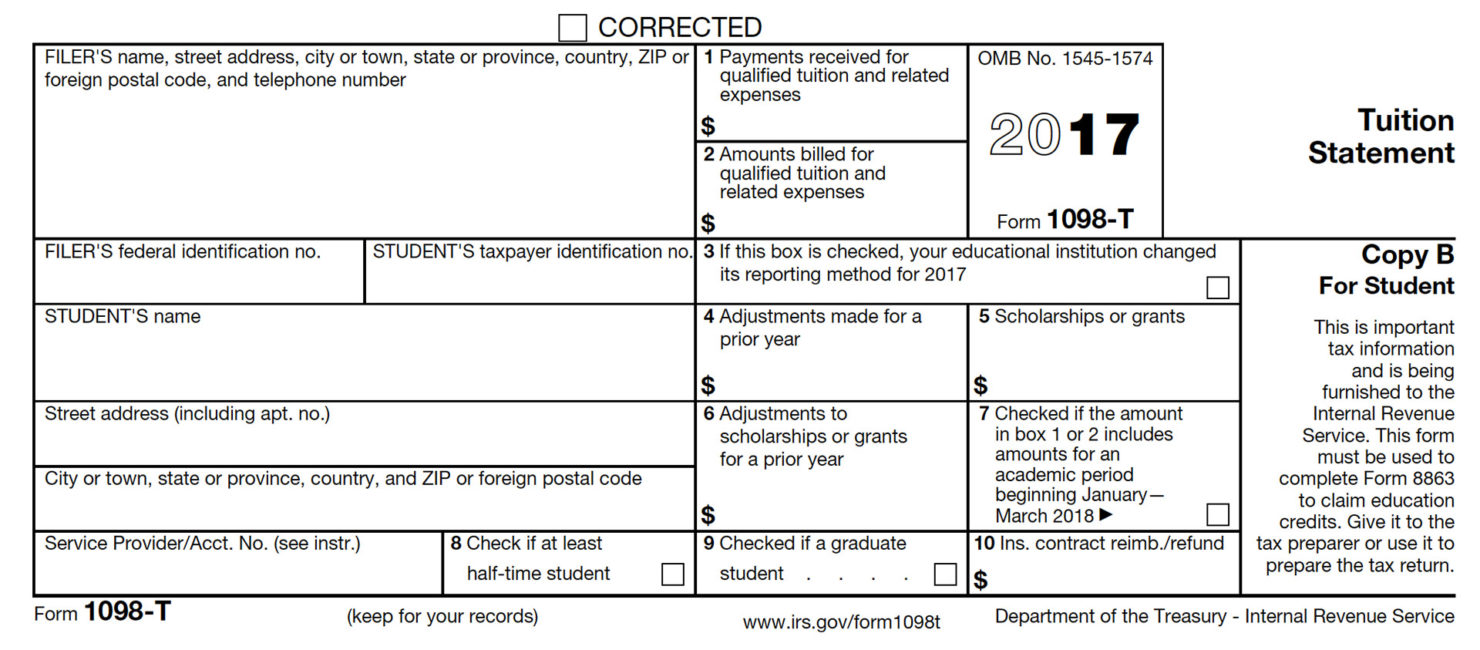

1098-T – What’s that?

Glad you asked! Each January, the IRS requires TJC to send out a form detailing how much tuition and fees you paid during the previous year.

Why do I need it?

If you are a dependent, your parents might take a tax credit or deduction based on qualified tuition and fee charges during the previous year. If your parents can’t claim you as a dependent, you may be able to deduct qualifying school expenses from your own taxes. Speak with a CPA or qualified tax preparer for more details.

What if I don’t get one?

We only send 1098-T forms to students who paid qualifying tuition or fees during the previous year. If you don’t pay out of pocket for tuition and fees, you probably won’t get a 1098-T in the mail.

Please check online at https://heartland.ecsi.net/ to see if there is a form available for you. If nothing comes up, then you more than likely did not qualify and will not be receiving the 1098-T.

When will I get one?

The IRS requires us to send 1098-T by Jan. 31.

Make sure your mailing address on file with TJC is correct. You can find your mailing address in Apache Access under Quick Links > Student Records > Personal Information. If you need to change your name or address, please go here for further instructions. Because 1098-T’s have been mailed this year (2018), please go to Heartland ECSI to retrieve your form.

I should have gotten one!

If you believe there’s been an error, please contact Heartland ECSI at 866-428-1098.

And that’s it! Again, ask a qualified tax preparer for more information about how the 1098-T will benefit you and your family, and let us know if you have any further questions.